Feeling in the dark about how your ISA savings will perform over time?

Without proper calculations, many people set unrealistic goals or miss opportunities to maximize their annual allowance.

Our ISA Calculator brings clarity by projecting your potential tax-free growth based on different contribution patterns and interest rates, turning vague savings hopes into concrete financial projections you can act upon with confidence.

ISA Calculator: Track Your Tax-Free Investment Growth

Use our Free Online ISA Calculator to calculate your Total Deposited vs Final Balance.

ISA Calculator

Estimate how much your ISA could be worth over time, considering an initial deposit, monthly contributions, and annual interest.

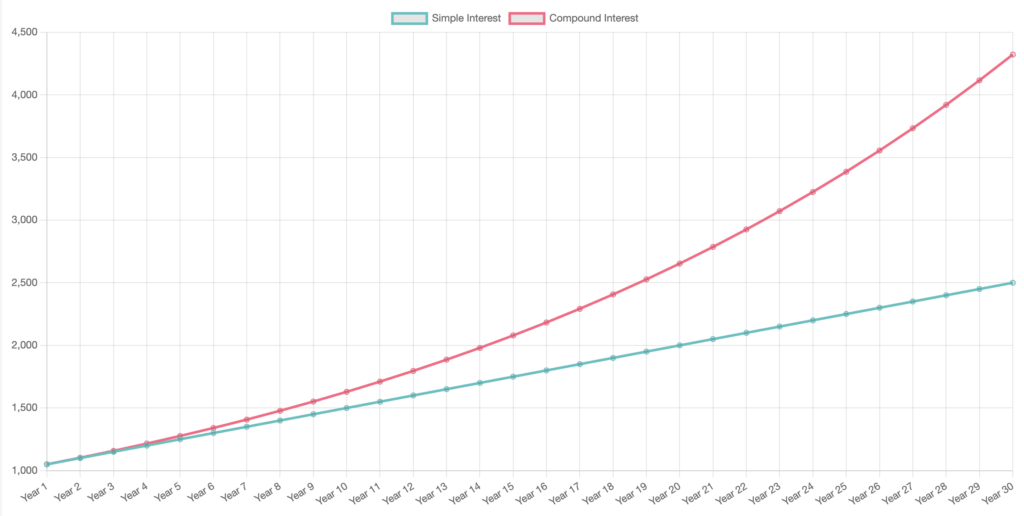

Visualizing Interest Rates and Compounding

Stacked Bar Chart: Annual Breakdown of Principal & Interest

Each bar represents one year. The lower (blue) portion is the principal carried forward, while the upper (orange) portion is the interest earned that year.

A Plain-English Guide to ISAs and Compounding

If you’ve ever wanted to grow your savings without giving a big chunk to the taxman, an Individual Savings Account (ISA) might be right up your alley.

This straightforward guide breaks down what an ISA is, how compounding supercharges your money, and why it all matters for your financial future.

What Exactly Is an ISA?

An ISA is a special UK savings or investment account (the same as the USA Roth IRA) where any interest, dividends, or capital gains you earn are tax-free. Because of this tax break, your balance can climb faster than it might in a regular savings account. Every tax year, you get an ISA allowance—this is the maximum amount you can put into ISAs in that year. Once the year’s gone, that allowance is history; you can’t roll it over.

Key Perks of ISAs:

1. No Tax on Earnings: Any interest or gains stay in your pocket.

2. Choice of Types: You’ll find different flavors, including Cash ISAs (basic savings) and Stocks & Shares ISAs (for investing).

3. Potential Growth: By sheltering your money from taxes, you could see a noticeable difference in the long run.

The Magic of Compounding

Everyone talks about “compounding,” but what does it actually mean? In essence, compounding is interest earning interest. Say you deposit £1,000 at 5% per year. After the first year, you have £1,050. The next year, that 5% applies to £1,050, so you end up with £1,102.50. It might seem modest at first, but given enough time, compounding can have a dramatic effect—especially if you add new funds along the way.

Why It Matters:

A lifetime isa calculator can help you show where your ISA can be in the future.

ISAs matter for a few very good reasons:

• Accelerated Growth: Over many years, those small interest-on-interest increments add up.

• Tax Advantage: Inside an ISA, your gains aren’t taxed, letting compounding work even harder for you.

• Low Effort: Once you’ve set up regular contributions, watch your balance build without constant tinkering.

Types of ISAs

1. Cash ISA: Works like a standard savings account but keeps your interest tax-free.

2. Stocks & Shares ISA: Lets you invest in funds, bonds, or individual stocks. Higher risk, potentially higher returns.

3. Lifetime ISA (LISA): Tailored for first-time homebuyers or retirement savings. The government even adds a bonus on your contributions.

4. Innovative Finance ISA (IFISA): Links you with alternative finance products, such as peer-to-peer lending.

Each type suits different goals and risk levels, so do a bit of homework before you jump in.

How to Make the Most of Your ISA

• Start Early: Time is a huge ally. The longer your money stays put, the more those compounding gains stack up.

• Regular Contributions: Drop in a set amount each month if you can. Steady deposits feed the compounding engine.

• Compare Rates: If you’re in a Cash ISA, shop around for competitive rates; if you’re in a Stocks & Shares ISA, review platform fees and potential returns.

• Stay Within Your Allowance: Keep an eye on the annual limit—once the tax year ends, that portion of the allowance is gone.

FAQ - Frequently Asked Questions on ISAs

What is an ISA?

An ISA is an Individual Savings Account for UK residents. It lets you save or invest money without paying tax on the interest, income or gains. The UK government sets a limit on how much you can put in ISAs each tax year. For the current tax year, this limit is £20,000 per person.

What types of ISAs can I open?

Four main types of ISAs exist:

Cash ISAs - These work like regular savings accounts but the interest is tax-free

Stocks and Shares ISAs - These let you invest in the stock market without paying tax on profits

Innovative Finance ISAs - These involve peer-to-peer lending with tax-free interest

Lifetime ISAs - These help you save for your first home or retirement with a government bonus

You can split your yearly allowance between different ISA types if you want.

Can I withdraw money from my ISA?

Yes, you can take money out of most ISAs at any time. But the rules vary by ISA type. Cash ISAs usually allow easy access, though some fixed-term cash ISAs might charge fees for early withdrawals. Lifetime ISAs have a 25% penalty if you withdraw for reasons other than buying your first home or retirement after age 60.

Can I have more than one ISA?

Yes. You can open one of each type of ISA per tax year. This means you could have a Cash ISA, a Stocks and Shares ISA, an Innovative Finance ISA, and a Lifetime ISA all in the same tax year. But your total deposits across all ISAs cannot exceed the £20,000 yearly limit.

What happens to my ISA if I move abroad?

You cannot open a new ISA if you move abroad and are no longer a UK resident. But you can keep any existing ISAs open and they will stay tax-free in the UK. Some ISA providers might ask you to close your account if you move abroad, so check with them. You can start paying into ISAs again if you return to the UK and become a UK resident.

Final Word

If growing wealth in a tax-smart way is on your radar, an ISA is hard to ignore.

Whether you’re saving for a rainy day or investing with an eye on retirement, the combination of tax benefits and compounding can give your money a real leg up.

Just pick the type of ISA that matches your comfort level and goals, start making contributions as early as possible, and let compounding do the heavy lifting.